By The Washington Post Dec 16, 2024

Christina Temple moved to Truckee, California, to buy her first home.

The small mountain town, a short drive from Lake Tahoe, offered the former preschool teacher and her husband, a carpenter, a shot at becoming middle class by escaping crushing housing costs near Santa Cruz, California.

“We moved up here for a better life,” she said in a phone interview. “For two or three years, we got that taste.”

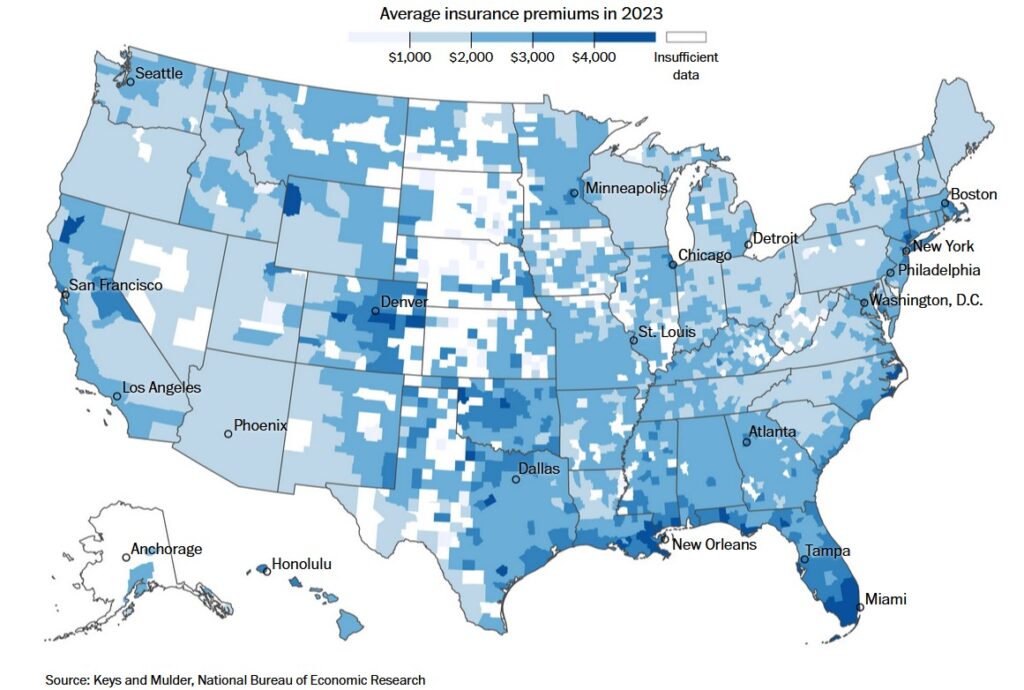

Then the insurance bills came. In 2017, the couple paid $1,100 to insure their small cabin. But since then, nine of California’s 10 largest wildfires have erupted, sending the insurance market into turmoil. Three insurers have dropped her in three years. This year, a basic policy from the public FAIR plan, the state-run insurer of last resort, and supplemental private insurance will cost Temple $6,000. It’s likely to rise again. “Now we’re back to watching each paycheck,” she said, “and budgeting for everything.”

Temple is among the many Americans watching their hold on homeownership slip away as insurance costs balloon beyond their ability to pay. “This is our first house. I don’t want to leave,” said Temple, struggling to keep her composure. “I try not to look too far into the future. I get scared.”

There’s no easy fix. A combination of broad economic trends — labor shortages, inflation, higher reinsurance and rebuilding costs — and more costly and uncertain extreme weather events are driving up premiums.

Homeowners face an unsettling reality: Insurers are passing these costs to consumers with higher rates and more restricted coverage. In some states, insurers have stopped issuing new policies altogether. Ordinary Americans must now make hard calculations: Can they afford to stay, or is there a way to navigate this new insurance market?

Historically, insurance was a win-win for everyone. Homeowners paid a small premium to receive a payout after a natural disaster or other loss. Insurers turned a profit by spreading the risk among homeowners across the country.

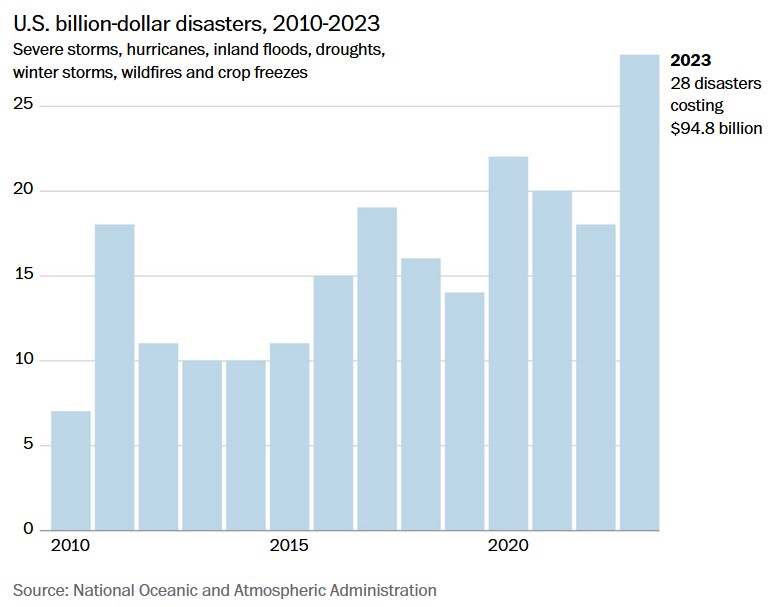

But costs from extreme weather events have been rising, in part because Americans have continued to move into areas that are more vulnerable to severe storms.

Underwriting losses among U.S. property insurers totaled $47 billion in 2022 and 2023 alone, according to AM Best, a global credit rating agency.

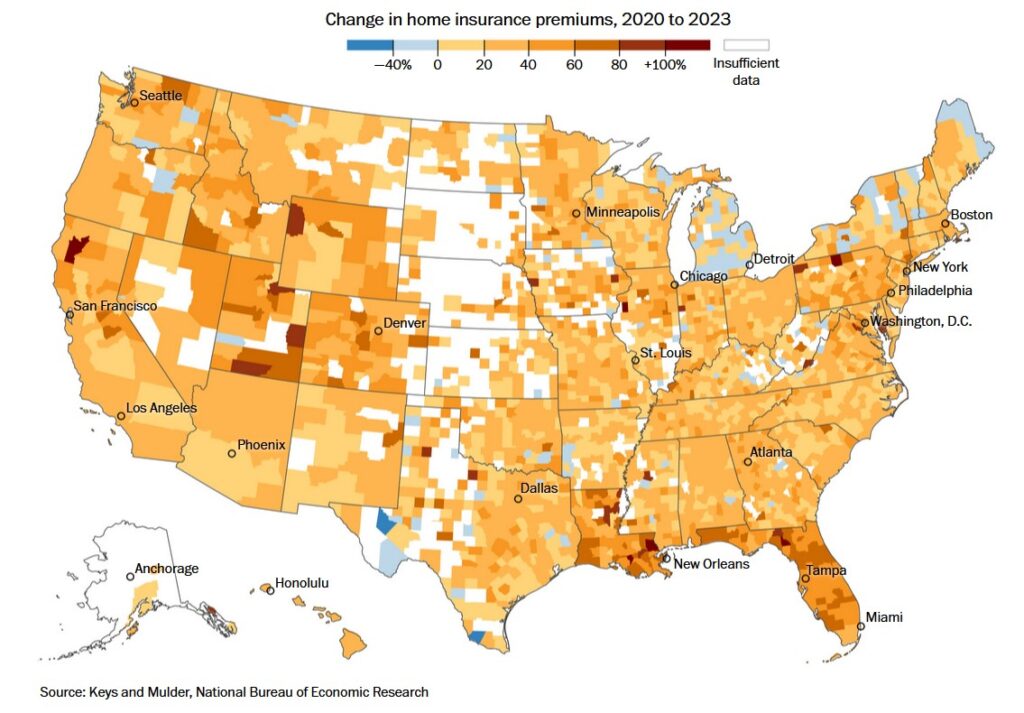

Property insurance premiums have risen by more than 30 percent since 2020, the last full year the industry posted an underwriting profit. And insurers are still fleeing markets — seven out of California’s top 12 carriers have curtailed coverage over the last two years — or going bankrupt. Public plans, once a last resort, are the largest (and sometimes only) affordable option in “insurance deserts,” where private insurers no longer offer new standard policies.

About 10 percent of U.S. homeowners are now forgoing insurance, double the recent rate. Or in some cases, they’re selling their homes citing insurance premiums that rival mortgage payments.

Sean Kevelighan, chief executive of the Insurance Information Institute, an industry group, expects we’ll pay even more as people move to riskier places. Losses are often subsidized by policyholders everywhere, even if residents of riskier Zip codes generally pay the most. Personal insurance is underpriced “almost across the board,” Kevelighan said. “As long as we see people living in ways that are riskier, the price of insurance is going to reflect that.”

That doesn’t mean insurance can’t work for you. The market is opaque and confusing. But there are ways to find plans that protect your home and safeguard your future amid intensifying climate risk.

It’s a new insurance world out there. Here’s a road map.

Request a (free) insurance bill of health for your property

Consider requesting a Comprehensive Loss Underwriting Exchange (CLUE) report. It’s the insurance equivalent of a credit score. It includes all the claims filed on a home or vehicle for the last seven years. If you have high premiums, check your own property’s bill of health (and fix any errors). If you want to buy a home, request it from the seller. You’ll quickly find out the property’s true claims history. You can request one free personal report online or over the phone each year from Lexis Nexis.

Consider flood insurance even if you’re not in a flood zone

You’re not safe from flooding even if you don’t technically live in a flood zone. The National Flood Insurance Program says more than 40 percent of its flood insurance claims came from outside high-risk flood areas between 2014 and 2018. For those living in the 100-year floodplain (what the Federal Emergency Management Agency (FEMA) deems high risk), there’s already a 25 percent chance of flooding during a typical 30-year mortgage.

Yet the number of households with flood insurance has been declining. Only about 4 percent of homeowners have flood insurance, according to the U.S. Government Accountability Office.

Do you need flood insurance, since historical data is no longer a precise guide? You can look up your community’s risks with our interactive tool. You can also check FEMA’s flood maps to see if your home lies within the 500-year floodplain — areas with 0.2 percent chance of flooding in any given year — to get a better sense of your risk as storms and rainfall intensify.

The main insurer is FEMA’s National Flood Insurance Program (NFIP), which offers plans in most communities across the country. You can find an agent here or get your own quote online. An increasing number of private insurers are also getting into the game, so get comparable quotes.

Depending on your state, there may only be a few — often expensive — private plans available. But more affordable plans are becoming available in lower-risk places, said Karl Susman, owner of Los Angeles-based Susman Insurance Agency. An annual flood policy for a half-million-dollar home can cost $100 and may even be added to your existing homeowner’s policy.

In riskier locales, coverage options may be expensive but worth it. “If it’s quite expensive, then that should tell you two things,” said Susman. “I’m in a really risky area and I really should have this.”

If you go without, don’t expect the federal government to help. FEMA disaster-relief payouts, which are need-based, average about $3,000 — and only if the U.S. government declares a disaster in your area. “Government programs don’t make you whole after disasters,” warned Amy Bach, the co-founder of United Policyholders, a public interest advocacy group. By contrast, flood insurance claims pay around $66,000 on average, according to the NFIP.

The worst thing you can do? Let lenders buy insurance for you. Banks usually demand mortgage holders carry insurance. If you let it lapse, or it’s deemed insufficient, these “lender-placed” policies don’t protect your home. It protects their loan. If your house is damaged or destroyed, the payout may not be enough to rebuild — and you’ll still have to pay your mortgage.

Customize your coverage — and beware of carve-outs

Insurers once worried most about “primary” perils such as hurricanes and earthquakes. Yet “secondary perils” such as hailstorms, tornadoes, thunderstorms and wildfires are racking up bigger costs. In 2020, these secondary threats caused more than 70 percent of insured losses from natural catastrophes, reports Swiss Re, a reinsurer.

Insurers have started carving these perils out of policies or imposing damage caps, meaning you’ll have to shop a la carte. “You used to be able to get one policy to cover all the perils and now it takes two policies to cover the same thing,” said Joyce Feldman, who owns Twin Valley Insurance Services in the fire-prone foothills of California’s Sierra Nevada range. “And people’s premiums are probably triple what they used to be.”

Most insurance policies come in three flavors. “Open peril” coverage encompasses damage from all disasters that are not explicitly excluded; “named peril” policies cover specific hazards; and hybrid policies (“HO-3”) offer different coverage for your house, personal belongings and personal liability. Make sure the one you choose addresses your area’s hazards: In regions prone to flooding, wind, hail and wildfire, standard homeowner policies often limit or even exclude coverage for those risks.

Get full replacement cost coverage if you can. Be wary of “functional” replacement coverage (instead of original materials, you may get cheaper substitutes). And “actual cash value” policies, which are also less expensive, won’t pay an item’s original price but its current value based on age, wear and tear, and other factors.

Look for “extended replacement coverage,” where carriers will pay to rebuild your home even if the loss exceeds your policy’s stated home value. Adding building code upgrade coverage pays for a share of the costs to rebuild to the most recent standards, which can be a big benefit in areas prone to disasters.

Is this more expensive? Yes. If you need to cut costs, raise your deductible and trim extras, like reimbursement for hotel costs if you have other options.

Finally, consider parametric insurance for your home if you’ll need cash right after a disaster. Some insurers offer to automatically pay you a small amount within days if a disaster is detected. These policies are particularly useful if you need cash to cover immediate expenses or a deductible. However, this does not replace primary insurance.

One pilot program in New York City, which relies on a mix of satellite data, on-the-ground real-time sensors and social media images to monitor flooding, promises enrollees as much as $15,000 within days of detecting a deluge. “It provides a stopgap to prevent climate disasters from becoming a downward spiral of an economic disaster,” said Kate Stillwell of Neptune Flood Insurance.

Shop around

Today, you can often find better deals by expanding your search rather than relying on one “captive” agent or broker who sells only one company’s policies. You can buy insurance directly online or get quotes, but it’s usually worth asking at least one independent insurance broker for quotes from multiple insurers.

If you’re struggling to get private insurance in areas at risk for wildfires or floods, get quotes from state-run property insurance programs known as Fair Access to Insurance Requirements (FAIR) plans. (California, Florida, Hawaii, New York and North Carolina offer them, among other states.) They generally offer limited coverage for high-risk properties at higher prices — but they may be your only option. Consider buying supplemental coverage and compare similar plans offered by private insurers.

When you’re ready to choose an insurer, don’t just choose a brand name. Experts once favored these “admitted” insurers, tightly regulated companies whose rates are subject to state approval. They also pay into a state fund guaranteeing policyholders are covered, even if the carrier goes bankrupt.

But as traditional insurers pull back, non-admitted insurers’ share of the market is growing. These carriers, also called excess and surplus insurers, are not as strictly regulated; they can set their own rates and typically specialize in high-risk policies. They are required to have sufficient financial backing, such as reinsurance or financial reserves.

Bach of United Policyholders said her group used to tell people to avoid non-admitted carriers. “But now we say just compare … the coverage you’ll get,” she said.

Susman advised that homeowners should focus on a firm’s financial stability, not its brand. Ask an agent about a company’s track record, financial reserves and how well its coverage matches the typical losses in your area.

You can check a firm’s ratings and reserves on AM Best, a rating agency that gives letter grades to 16,000 insurance companies. (Register on AM Best here free and use this guide on how to search.)

Seek out an “A” or above. Some brand names may have low ratings (State Farm’s California subsidiary was recently downgraded to a “B”), while new firms may rank higher. Beware of unlisted companies, Susman warned. “These little nobodies are starting companies to try and grab money while they can.”

Harden your home against extreme weather

Preventing a loss is always cheaper than claiming it. There’s no universal list of ways to reduce your premiums. But Bach’s group is pressuring insurers to disclose steps homeowners can take to reduce risks and lower their rates. “It seems like it’s the only thing that’s going to help consumers,” she said.

Donald Brudos, in Cape Coral, Fla. was required to raise his home after a hurricane destroyed it to keep federal flood insurance. (Thomas Simonetti for The Washington Post)

Prepare your home so that it can withstand extreme weather better. For now, FEMA, state FAIR plans, private insurers, agents and even local fire departments offer advice on how to minimize damage from fire, flood and wind. If a disaster strikes, these investments can pay for themselves several times over. Communities can also cooperate through prevention programs such as Firewise.

Insurers and governments rarely pay for this, but that’s changing. Kin Insurance has compiled a list of state programs, such as California’s Safer from Wildfires program and the My Safe Florida Home Program, which help homeowners upgrade their property. Insurers such as Hippo are beginning to offer discounts for preventive measures, such as removing flammable brush and trees around homes.

Bailing out may make sense

More places in the United States will become unaffordable for the average person to insure, especially along the coasts, predicts Nancy Watkins, who analyzes insurance risks and pricing for the global consulting firm Milliman. “Because the risk is going up,” she said, “prices will go up.”

First, look up your community’s risks with our interactive tool, or see property-specific risks at Realtor.com, ClimateCheck and, soon, Zillow. Then decide if it makes sense to leave before these risks materialize.

In places regularly exposed to flooding, federal and local governments are already buying out properties. Over the past 30 years, FEMA has spent billions of dollars on voluntary buyouts of more than 40,000 flood-prone properties. But that’s unlikely to keep pace with rising waters. By 2050, according to Harvard Law School professor Susan Crawford, millions of Americans may need buyouts. At today’s pace, only a tiny fraction of households will receive them.

Instead, the cost of insurance in risky places is likely to redraw the map where people can live, argued Georgia Institute of Technology professor Brian Stone, who directs the university’s Urban Climate Lab.

He pointed to Gatineau, a city in Quebec that experienced two 100-year floods within three years. The provincial government required owners of heavily damaged homes who received relief money to either leave the flood zone or, if they chose to rebuild, relinquish claim to any public relief funds for themselves and future owners. Homeowners across Canada have been put on notice that anyone rebuilding in dangerous flood zones may lose out on relief funds.

Stone said this offers a preview for the rest of the world. “The forcing mechanism is going to be insurance buyouts,” Stone said. “But we have to do it in advance of the crisis, not in the aftermath.”

Click here to see full article